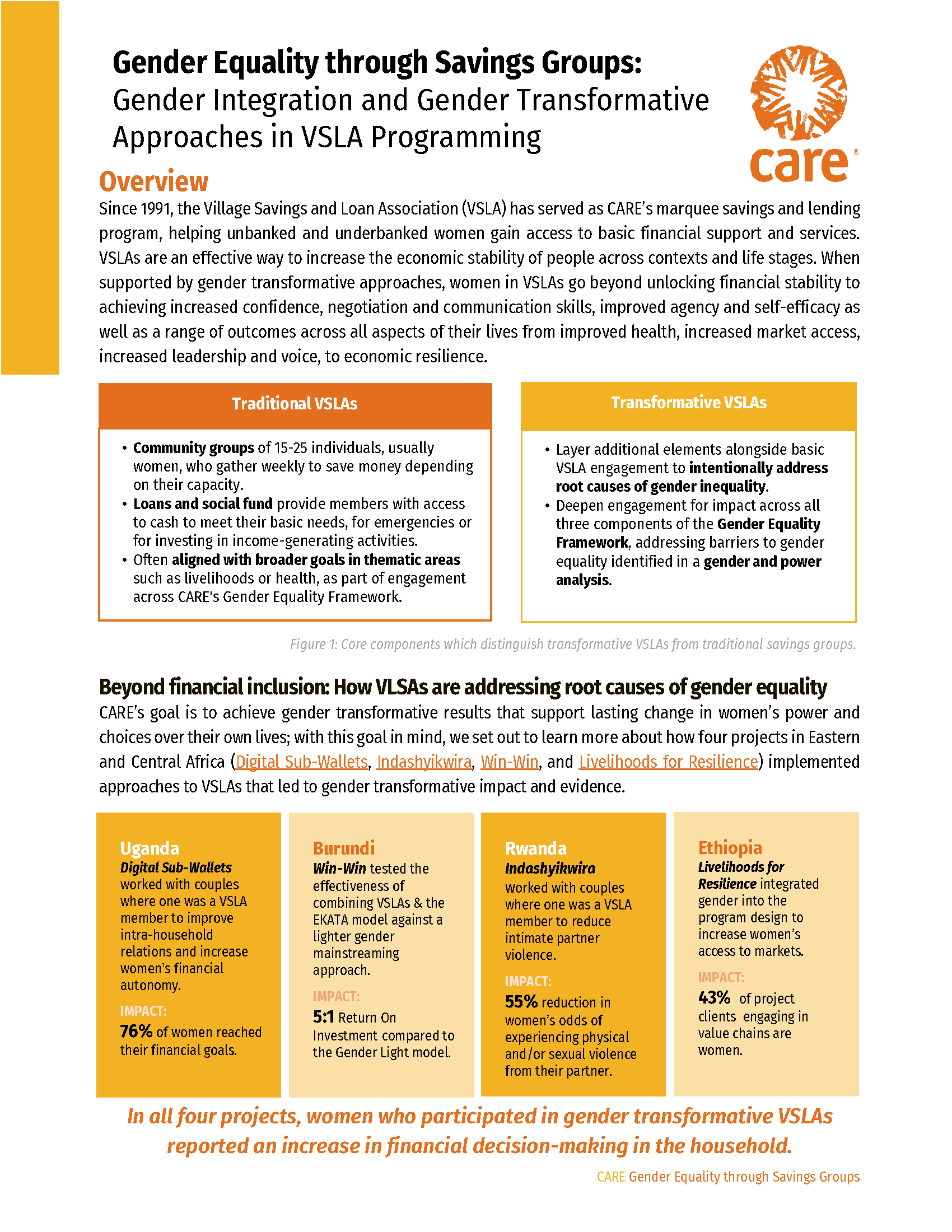

CARE has operated savings and lending programs through Village Savings and Loan Association (VSLAs) since 1991. This learning brief outlines CARE’s strategies to advance gender equality in these programs. The brief details experience from four VSLA projects in Uganda, Burundi, Rwanda, and Ethiopia which added gender transformative approaches to the traditional savings group model. Among them is the Digital Sub-Wallets project aimed to promote gender equality in western Uganda through two interventions: mobile banking and household financial counseling.

article

Gender Equality through Savings Groups:

Gender Integration and Gender Transformative

Approaches in VSLA Programming

Published by

2023

CARE

Have you found this Resource useful?