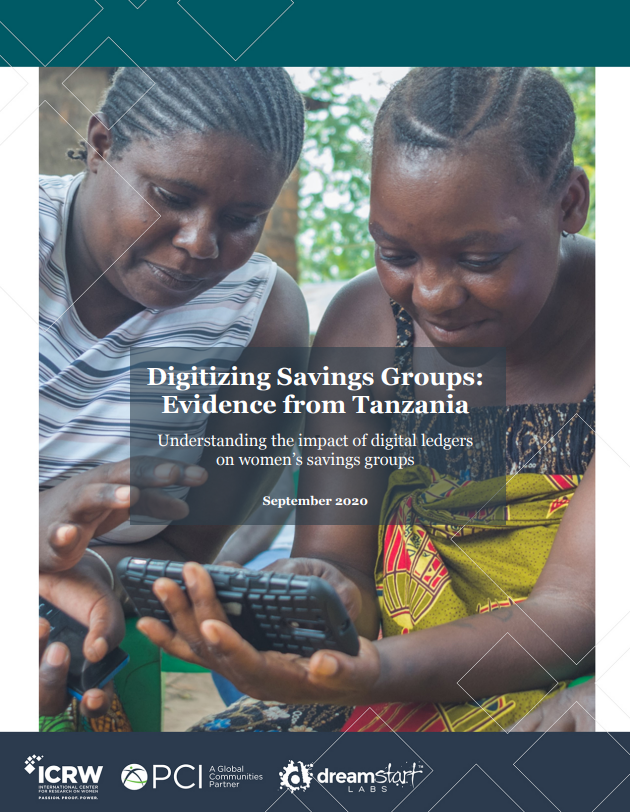

FinEquity’s 2023 Annual Meeting explored the nexus linking financial inclusion, women’s empowerment, and climate change, with the purpose of understanding how financial services can help women adapt their livelihoods to erratic rainfall patterns and rising temperatures to mitigate climate risks. Among others, the speakers addressed digitally-enabled financial inclusion, stressing the importance of designing digital financial services (DFS) with a gender lens and closing the digital divide, including through digital literacy strengthening. For example, in the session Perspectives on Financial Inclusion for Women’s Empowerment & Climate Transition the panelists discussed the opportunities and challenges of DFS in the context of climate change and cited the benefits of savings groups digitally linked to formal finance.

Multimedia

Digital Inclusion

Digital Literacy

Digitization Benefits

Digitization Risks & Barriers

Financial Inclusion

Formal Finance

Gender

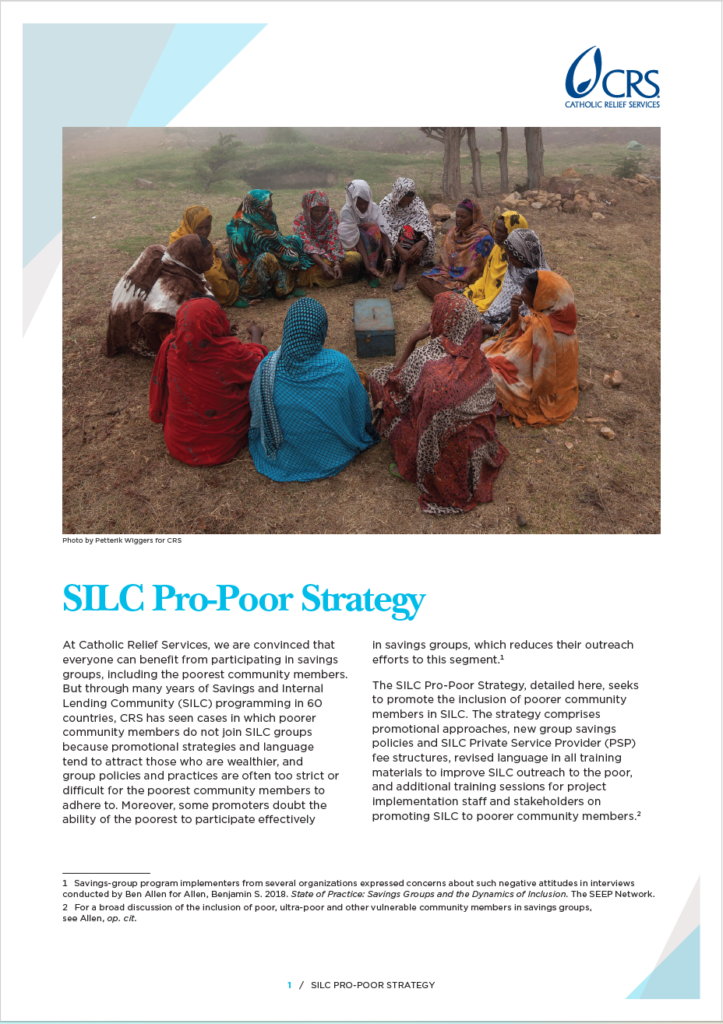

Informal Finance

Social Inclusion

FinEquity 2023 Annual Meeting

Published by

2023

CGAP

Have you found this Resource useful?