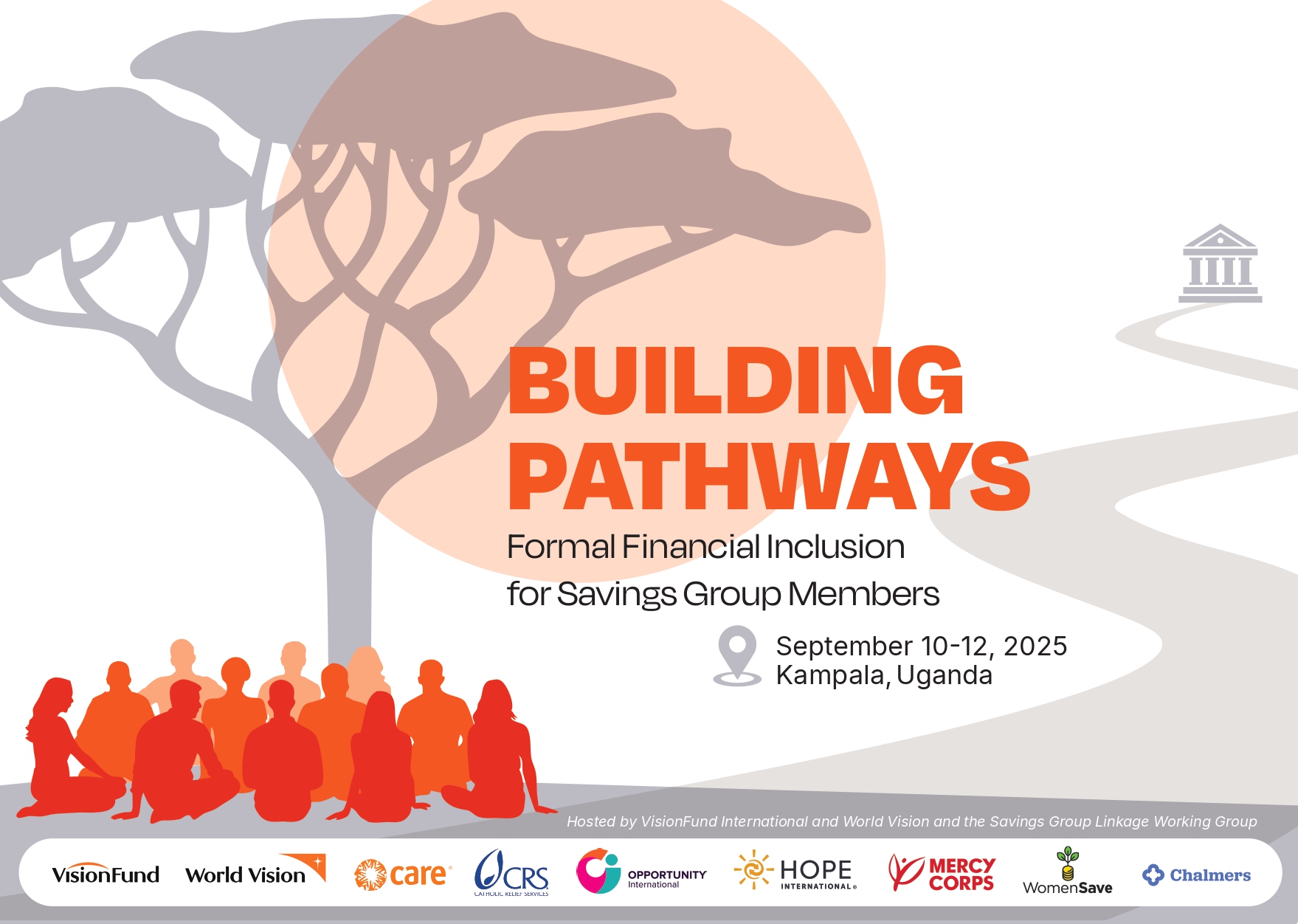

The Building Pathways conference brought together key stakeholders to address a critical challenge in financial inclusion and poverty reduction: bringing capital and other financial services like insurance to financially excluded populations through village-level savings and loans groups (Savings Groups, SGs). These groups, in which women mobilize their own resources, have provided a vital source of investment and cash flow to people excluded from the formal financial system, especially rural women in Africa. SG borrowers account for 20% of all borrowers, more than those borrowing from formal institutions (14%) or from mobile money operators (11%) (See World Bank FINDEX data, 2025). But, with access to formal finance, SGs can deliver larger loans to help enterprises grow and provide all members with financing at the same time, particularly during planting season to enable investment in agriculture.

View the Conference slides here