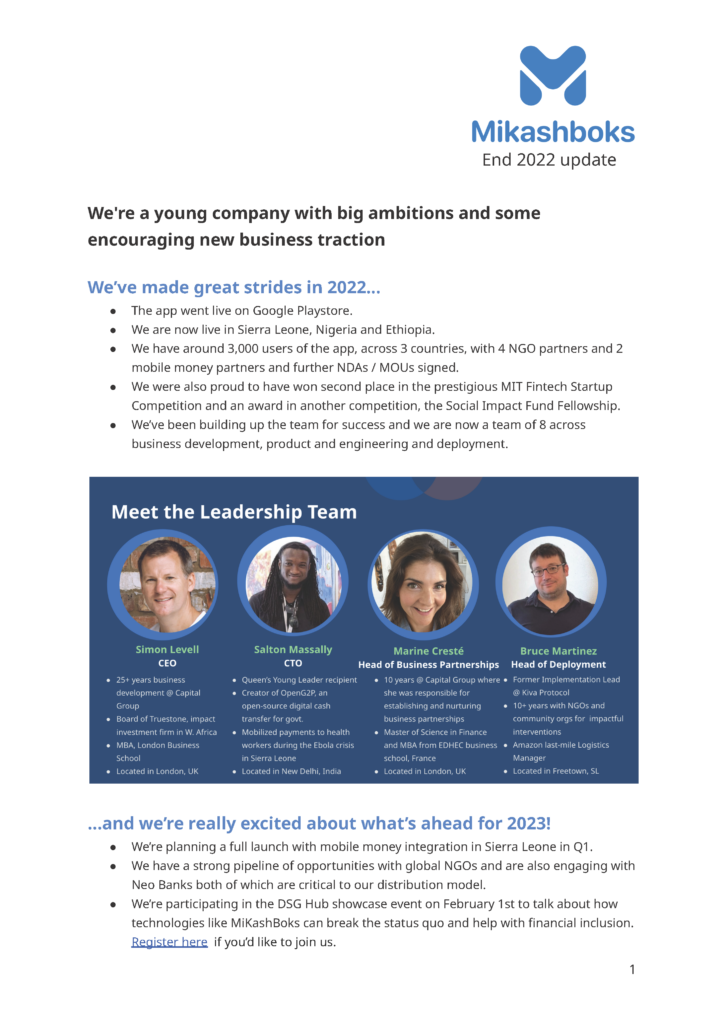

About MiKashBoks

MiKashBoks is a people-focused financial platform built on existing and thriving community savings and lending practices. We see the value in the informal transactions that comprise so much of the financial lives of the unbanked billion.

MiKashBoks is designed to work for these communities, augmenting what they do well. We build on, rather than seek to replace, community trust and connection. In addition, we provide a secure way for our users to build credit and grow their saving and lending capabilities.

What We Do

The Problem

1.7 billion people around the world do not have access to bank accounts. Millions of them use community savings groups as an alternative. Members in these groups save and borrow together, using these transactions to make investments and earn a return. The groups are based on trust rooted in social bonds in their communities. $500 billion flows through these groups every year. Often, however, their impact is limited because they are run manually with paper ledgers, which are hard to manage. These groups’ financial lives are invisible outside of their group and many members are locked out of formal finance. MiKashBoks ends that invisibility.

Our Solution

MiKashBoks is an app that brings savings groups online. It is as intuitive as creating a WhatsApp group. MiKashBoks makes saving and lending easier and safer. Groups can use the app to manage their savings, replacing manual recordkeeping. MiKashBoks gives the excluded access to financial services. They can build a credit history in the app and get connected to a marketplace of financial services like loans at better rates. MiKashBoks can be used in any country with access to Google Play Store.

Our Partners

We work closely with several groups to make our services available to our customers:

- Non-governmental organizations (NGOs) operate thousands of self-help groups around the world. Because most of this work is done manually, they lack visibility and rely on out of date and often inaccurate records. We provide them with a dashboard with real-time data on their groups so they can improve their operations and report impact to donors.

- Financial institutions cannot currently service these groups without it being expensive and risky. We provide them with access to users with a financial profile in a cost-effective, less risky way.

- Payment providers such as mobile money operators want to increase the usage of their platform. The inherently social nature of MiKashBoks provides a compelling proposition to drive growth.

How It Works

MiKashBoks operates in two modes, both of which are connected to an admin dashboard:

- Digital ledger: in-app bookkeeping with all funds kept as physical cash.

- Digital savings: same functionality as the digital ledger but transactions occur via an in-app integration with a Digital Payment Provider (DPP).

Digital Ledger

We provide a digital record of the group’s transactions (saving and lending activities) in the app to replace offline recordkeeping. Members can log in and monitor their own transactions and that of the group, facilitating transparency. The app is designed to be totally flexible and easy to use. Members set their own rules such as number of members, duration of saving cycles and loan repayment rules. The cash is kept physically (offline) which allows participation of members who – whether by choice or circumstance – do not use a digital payment provider or a smartphone.

Only one Android smartphone is needed per group. Members without a phone can be part of the group using MiKashBoks as long as the group’s secretary has added them as a member in the app. If other members of the group have smartphones they can access all of the same tools as the secretary except being able to record meetings. If members do not have access to a smartphone but have a feature phone, they can receive SMS notifications on group business and updates on their transactions. All members will gain a financial profile, accessible by financial service providers and other interested parties.

Digital Savings

MiKashBoks’ digital ledger operates in the same way but with additional integration with a DPP so the cash is held digitally. MiKashBoks is NOT a financial provider: we do not hold the deposits (they are held by the DPP in a MiKashBoks escrow wallet) and we do not make the loans. The DPP acts as a payment gateway through which deposits and loans flow through. When users make a deposit or receive a payout, money is moved from their payment provider wallet to MiKashBoks wallet and vice-versa. The group assets are held in a MiKashBoks wallet on the DPP system.

Costs

Pricing is dependent on each partner’s particular circumstances and requirements, but here are some general principles that we follow:

- MiKashBoks ledger. We do not charge anything to the end users for the ledger version of our product. We charge the NGO partner a monthly licensing fee for access to the dashboard and ongoing support, based on the number of groups they have on the platform. It is a tiered pricing so the more groups you have, the cheaper it works out per group. In any case, it typically works out at less than USD1 per year per member. There may also be an upfront fee for initial implementation & potential customization (e.g. language).

- MiKashBoks wallet. When MiKashBoks is linked to online money providers and/or financial institutions and users are making profits on their savings, we take a small fee on their benefits and we charge an arrangement fee to financial institutions we partner with.